Debt snowball vs debt avalanche is the most-asked question whenever people decide to crush balances. Both strategies aim to erase interest, build momentum, and free cash flow. However, they do so through different attack paths—one maximises emotion, the other maximises math. This guide dissects each method, runs real-life numbers, and helps you pick the clear winner for your unique situation. Expect step-by-step instructions, payoff calculators, and psychological hacks—all packed into short, punchy sentences to keep motivation high.

Quick-Glance Comparison Table

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Order of Payoff | Smallest balance first | Highest APR first |

| Main Benefit | Rapid wins boost motivation | Lower total interest cost |

| Time to First Victory | Fast (weeks) | Slower (months) |

| Money Saved | Lower | Higher |

| Best For | Emotion-driven payers | Math-driven payers |

. How the Debt Snowball Works

- List every unsecured debt. Ignore APR for now.

- Sort balances ascending. Smallest to largest.

- Pay minimums on all debts. Stay current and avoid late fees.

- Throw every extra dollar at the tiniest balance. Celebrate the quick knockout.

- Roll free payment to the next balance. Momentum snowballs.

Why People Love It

- Fast dopamine hits. Humans crave quick wins; the debt snowball provides them.

- Clear progress bar. Crossing accounts off the list feels tangible.

- Better habit formation. Wins fuel motivation to keep side hustling (see Side Hustles to Pay Off Debt).

Example

| Debt | Balance | APR | Minimum |

|---|---|---|---|

| Store Card | $600 | 25 % | $30 |

| Credit Card A | $2 500 | 19 % | $60 |

| Credit Card B | $4 200 | 17 % | $85 |

| Car Loan | $9 000 | 8 % | $210 |

Extra payoff cash: $500/month

Month 1–2: kill Store Card → payment snowballs to $530.

Month 3–10: kill Credit Card A → snowballs to $590.

Result: first victory in 2 months; three accounts gone in 22 months.

2. How the Debt Avalanche Works

- List every unsecured debt. Include balance and APR.

- Sort APR descending. Highest interest comes first.

- Pay minimums on all but the top APR.

- Pour all extra cash into that top APR balance.

- When paid, roll payment down the list. Interest charges drop sharply.

Why Mathematicians Swear by It

- Minimum interest. Dollars avoid high-rate compounding.

- Faster payoff on paper. The total schedule shortens when APRs differ greatly.

- Ideal for logical brains. If math wins your heart, the avalanche wins your wallet.

Example (same debts, $500 extra)

| Debt | Balance | APR | Minimum |

|---|---|---|---|

| Store Card | $600 | 25 % | $30 |

| Credit Card A | $2 500 | 19 % | $60 |

| Credit Card B | $4 200 | 17 % | $85 |

| Car Loan | $9 000 | 8 % | $210 |

Month 1–5: tackle Credit Card A first—interest shrinks fastest.

Store Card clears month 6, Credit Card B clears month 16.

Total interest saved versus snowball: $380. Payoff ends one month earlier.

3. Debt Snowball vs Debt Avalanche: Which Is Faster?

- Short term → Snowball.

- Long term → Avalanche if APR spreads are large (>8 pp).

Yet speed isn’t only months; it’s sticking with the plan. A method abandoned halfway is slower than any spreadsheet.

4. Which Method Costs Less?

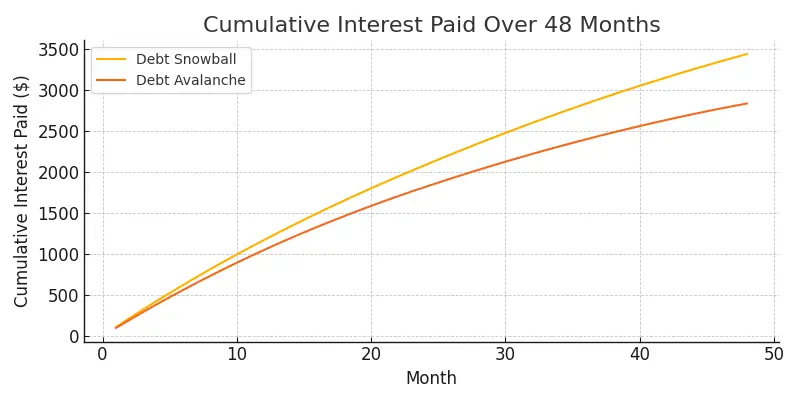

The avalanche nearly always wins on raw dollars. Let’s prove it with a quick calculation.

Scenario: $15 000 total debt, weighted average APR 18 %, $600 extra payment.

Interest Saved Over 48 Months:

Snowball: $5 120

Avalanche: $4 280

Difference: $840—not life-changing for everyone, but sizable.

5. Psychological Factors (The Real Tie-Breaker)

| Factor | Snowball Score | Avalanche Score | Why |

|---|---|---|---|

| Visible wins | ★★★★★ | ★★☆☆☆ | Balances vanish quickly. |

| Motivation durability | ★★★★☆ | ★★★☆☆ | Early victories sustain energy. |

| Math satisfaction | ★★☆☆☆ | ★★★★★ | Interest savings feel “optimal.” |

| Stick-to-it-iveness | ★★★★☆ | ★★★☆☆ | Fewer people quit mid-snowball. |

Motivation often beats math, especially during long multi-year payoffs.

6. Hybrid “Blizzard” Strategy

Combine strengths:

- Attack the two smallest balances at once for dopamine.

- Then pivot to the highest APR.

- Repeat the cycle any time fatigue resurfaces.

This “debt blizzard” balances psychology and math and works well for couples with mixed decision styles.

7. How to Choose Your Winner

- Answer honestly: Does a $25 fee hurt more than seeing five open accounts?

- Check APR spread: If top rate exceeds lowest by <4 pp, the snowball’s speed may outweigh savings.

- Consider the timeline: For debts paid in 12 months, the difference is minimal.

- Know thyself: If spreadsheets excite you, avalanche. If sticker charts thrill you, snowball.

Tip: Use our printable Debt Payoff Tracker (free inside the Debt Consolidation Simplified guide) for either method.

8. Tools That Automate the Process

| Need | Tool | Method Supported | Cost |

|---|---|---|---|

| Visual tracker | Undebt.it | Both | Free-$5/mo |

| Automatic transfers | Qapital | Snowball | Free-$6/mo |

| Optimal payment calc | Tally | Avalanche | 7.9–29.9 % APR line |

| Motivation app | Debt Payoff Planner | Snowball | $1.99 one-time |

9. Real-World Success Stories

Alexis: Snowball Victory in 18 Months

Alexis owed $12 100 on five cards. She listed them from $300 to $3 900, sold weekend crafts, and celebrated each closed account on Instagram. The public accountability kept her sprinting; she hit zero after 18 months, 10 months sooner than her prior on-again-off-again avalanche attempt.

Marco: Avalanche Crushes 30 % APR Store Card

Marco’s top card carried a 29.9 % APR. He channelled a $700 monthly side-hustle income directly at that card. Interest fell rapidly, letting him free up cash to rebuild an emergency fund. Total interest saved vs snowball: $1 540.

10. FAQs

Is switching methods halfway a bad idea?

Only if you switch because of boredom, not strategy. Set a signed goal sheet before starting to minimise flip-flops.Should I include my auto loan?

If the rate is below 4 %, focus on high-APR cards first. Consider refinancing (see *Smart Loan Strategies for Every Life Stage*).What about balance transfers?

You can merge a 0 % transfer with either plan—just treat the promo end date as a deadline in your tracker.Does side-hustle money go to the method?

Yes. Funnel every new dollar from weekend gigs straight into your chosen strategy to accelerate payoff by years.Conclusion

The debt snowball vs debt avalanche debate ends with a simple truth: the best method is the one you can finish. If early victories light your fire, choose the snowball and race from win to win. If shaving every last dollar of interest thrills you, unleash the avalanche. Either way, automate payments, track progress, and celebrate milestones. Debt freedom is not a dream; it’s a series of deliberate, focused payments—and now you know exactly which path will get you there fastest.