Side hustles to pay off debt, inject fresh cash into strained budgets, and shrink balances faster than any interest-rate hack. Beginning this very weekend, you can turn underused skills—or simply idle hours—into a steady flow of extra income that targets principal, accelerates your payoff timeline, and rekindles your financial optimism. This in-depth guide walks you through choosing, launching, and optimizing seven proven weekend gigs while avoiding burnout and costly tax mistakes.

1. Why Weekend Side Hustles Work So Well

- Immediate cash flow. Payroll cycles at most gigs hit your account within 48 hours, letting you slam extra dollars into monthly card or loan payments before the next compounding period. For more details, see our guide on budgeting strategies and cash flow.

- Low career disruption. You keep your primary salary (and benefits) intact while diverting gig income strictly to debt principal.

- Psychological momentum. Seeing balances fall each Monday motivates you to spend less and hustle smarter the following week.

- Seasonal flexibility. Need a break? Pause any weekend side hustles to pay off debt during exam weeks, holidays, or family events without quitting a day job.

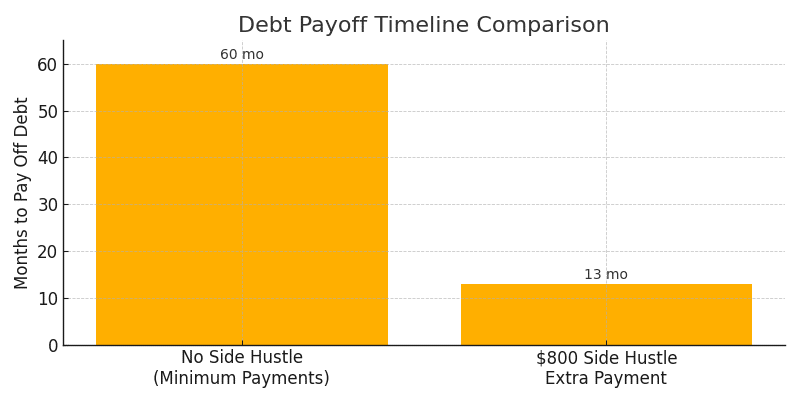

Quick Stat: NerdWallet found that an additional $600 per month applied to a $7,500 credit-card balance at 22 % APR eliminates the debt in 13 months instead of 51, saving $4,082 in interest.

2. Selecting the Right Gig for YOUR Debt Journey

Before you dive into the specific side hustles to pay off debt, vet each option using this five-point checklist:

| Criterion | Guiding Question | Ideal Answer |

|---|---|---|

| Skill match | Does the gig leverage a talent I already have? | Yes—minimal up-skilling needed |

| Time fit | Will it fit between Friday 6 p.m. and Sunday 8 p.m.? | Absolutely |

| Net hourly rate | After fees, gas, and taxes, am I clearing >$20/hr? | Preferably $25+ |

| Scalability | Can I double hours or raise prices after month two? | Yes |

| Enjoyment level | Will I resent doing this every weekend? | No—pleasant or at least tolerable |

Complete the checklist for each idea below, then start with the best personal fit.

3. The Seven Highest-Leverage Weekend Gigs

3.1 Freelance Micro-Tasks (Upwork & Fiverr)

Typical net pay: $25–$60/hr

Perfect for: Writing, graphic design, video subtitles, data cleanup

How to Launch

- Create a single gig with a narrow deliverable (e.g., “Proofread 1,000-word blog post in 24 h”).

- Price 20 % below market for the first three reviews.

- Deliver ahead of the deadline, and ask for a quick five-star rating.

Debt Impact

Four hours each Saturday × $40/hr = $640/mo toward principal. On a $ 5,000 card at 19 % APR, you erase the balance in nine months rather than 24.

Level-Up Tips

- Batch similar orders on Sunday morning to protect family time.

- Upsell add-ons like “plagiarism scan” for +$5.

- Use a free time-tracking app such as Toggl to measure your true hourly rate.

3.2 Rideshare & Delivery Driving (Uber, Lyft, DoorDash, Spark)

Typical net pay: $18–$30/hr in midsize U.S. cities

Perfect for: Car owners who enjoy podcasts and open roads

How to Launch

- Clean vehicle, photograph documents, and complete onboarding mid-week.

- Drive during surge windows—Friday 6–11 p.m. and Sunday brunch.

- Track mileage with Stride or MileIQ for tax deductions.

Debt Impact

Two five-hour shifts at $22/hr = $220/week or $880/mo. Apply the snowball method and watch your smallest balance vanish.

See our guide Budgeting 101 for more details about budgeting methods.

Fuel Hacks

- Use a 5 % cash-back gas card.

- Find Kroger or Costco stations to knock 25–40 ¢/gal off retail.

- Keep tire pressure at specs to save 1–2 mpg.

3.3 Pet Sitting & Dog Walking (Rover, Wag, Nextdoor)

Typical net pay: $20–$35 per 30-minute walk; $50–$75 per overnight

Perfect for: Animal lovers with a fenced yard

How to Launch

- Post a friendly headshot and highlight prior pet experience.

- Offer “first walk free” to secure testimonials fast.

- Bundle services—walk + nail trim + photo update—to raise ticket size.

Debt Impact

Three overnight bookings each holiday weekend can replace an entire minimum payment on a $ 3,200 Visa card, saving $38 in interest that month alone.

Safety & Insurance

Always meet pets outdoors first, require vaccination proof, and add Rover’s built-in liability insurance for peace of mind.

3.4 Online Tutoring (Wyzant, Preply, Varsity Tutors)

Typical net pay: $25–$50 per 45-minute session

Perfect for: Teachers, professionals, or bilingual speakers

How to Launch

- List specialty subjects (SAT math, conversational Spanish, Excel basics).

- Set evening slots on Friday and Saturday to attract APAC students during their daytime.

- Offer a free 15-minute consultation to convert leads.

Debt Impact

Six sessions per weekend = $600+ monthly. Direct that to the highest-interest card first for maximum savings.

Retention Tip

Email a progress report after every fifth lesson—parent satisfaction skyrockets and so do repeat bookings.

3.5 Print-on-Demand Etsy Shop

Typical net pay: $8–$12 profit per mug, shirt, or tote

Perfect for: Creatives comfortable with Canva & basic SEO

How to Launch

- Brainstorm micro-niches—example: motivational quotes about side hustles to pay off debt.

- Design three items, upload to Etsy via Printify or Printful.

- Research keywords with eRank; place the top phrase in the product title and the first 160 description characters.

Debt Impact

Sell 60 mugs at $8 profit = $480/mo. Target a $ 7,000 personal loan at 11 % APR and shave 14 months off the amortization schedule.

Automation

Schedule social posts with Tailwind; integrate Etsy-QuickBooks to auto-sync books for quarterly taxes.

3.6 Event Staffing & Bartending

Typical net pay: $150–$300 per evening plus tips

Perfect for: Extroverts who can stand long hours

How to Launch

- Register with local caterers or gig platforms (Instawork, Qwick).

- Complete an online alcohol-safety certificate (~$10).

- Keep a basic black-white attire kit in your car.

Debt Impact

Two weddings a month at $250 each = $500/mo applied to the debt snowball. A $ 10,000 balance at 18 % APR disappears 11 months sooner, saving $ 1,540 in interest.

Health Tip

Use compression socks and protein bars to prevent fatigue and maintain top-tier customer service for bigger tips.

3.7 Local Handyman & Odd Jobs (TaskRabbit, Facebook Marketplace)

Typical net pay: $30–$60/hr

Perfect for: DIY fans with a well-stocked tool bag

How to Launch

- Photograph before–and–after shots of home repairs and post to neighborhood groups.

- Set a two-hour minimum to avoid half-day “time vampires.”

- Offer package deals: “Mount three TVs for $200.”

Debt Impact

Replacing two ceiling fans on Saturday morning at $120 each grosses $240. Repeat every weekend to channel $960/mo toward your consolidation loan.

Safety & Liability

Carry general liability coverage (about $35/month), keep digital invoices, and require the client to supply special-order parts.

4. How to Manage Taxes & Legalities

- Separate accounts. Open a free business checking account (e.g., Bluevine) so every dollar from side hustles to pay off debt is trackable.

- Quarterly payments. Save 20–25 % of net earnings in a high-yield savings sub-account for estimated federal and state taxes.

- Self-employment deductions. Mileage, home office space, software subscriptions, and small-tool purchases reduce taxable income—track everything in Wave or QuickBooks Self-Employed.

- Consider an LLC once profit exceeds $1,000–$1,500 monthly or you need liability protection (pet sitting, handyman). Filing costs range $50–$300, depending on the state.

5. Balancing Hustle, Health, and Family

Side hustles to pay off debt should improve—not ruin—your life. Use these guardrails:

| Risk | Prevention Strategy |

|---|---|

| Burnout | Cap gig hours to 12/weekend; schedule a rest weekend monthly. |

| Relationship strain | Share the payoff plan with partners; budget a small “fun” slice from gig income to celebrate milestones together. |

| Physical fatigue | Invest in ergonomic gear (anti-fatigue mats, supportive shoes) and block 7–8 hours of sleep nightly. |

| Financial drift | Cap gig hours at 12 per week and schedule a rest weekend monthly. |

6. Real Success Stories

Carlos: From $ 19,000 in Credit-Card Debt to Debt-Free in 14 Months

Carlos mixed DoorDash driving on Friday nights with Sunday-morning algebra tutoring. Averaging $550 in weekly gig earnings, he funneled every cent to his highest-APR card, then rolled payments to the next balance. By month 14, he reached $0 owed and shifted the same $550 into an index-fund IRA.

Maya: Paid Student Loans Before Age 30 With an Etsy Sticker Shop

Maya designed “Debt-Free Journey” tracker stickers and sold 400 packs monthly at $3 profit each. After Etsy fees, her net $ 1,200/month eliminated $ 10,000 in student loans two years ahead of schedule. Today, she keeps the store open but invests profits into a 529 college fund for her newborn.

Sam & Riley: Couple Tackles Medical Bills Through Event Bartending

The duo worked two weddings per month, pocketing $600 each time. Applying $ 1,200 monthly to a $ 12,500 medical balance cleared it in 11 months, saving $ 1,800 in projected finance charges. They now bartend at one event quarterly to boost their emergency fund.

7. Tools & Apps That Turbo-Charge Your Hustle

| Need | Tool | Cost | Key Benefit |

|---|---|---|---|

| Mileage tracking | Stride, MileIQ | Free–$59/yr | IRS-compliant logs |

| Time logging | Toggl | Free | Nets true hourly rate |

| Budget route planning | GridWise | Free | Finds high-surge zones |

| Etsy keyword research | eRank, EverBee | Free–$10/mo | SEO for print-on-demand |

| Invoicing & Taxes | Wave, QuickBooks SE | Free–$20/mo | Separate personal & gig expenses |

8. Frequently Asked Questions (Collapsible HTML)

How fast can I erase $10 000 in credit-card debt?

Which gig suits introverts best?

Do I really need an LLC?

What if I have an older car?

9. Conclusion

Consistent side hustles to pay off debt transform scattered weekend hours into a focused attack plan on your balances. You pick one gig today—maybe two next quarter—then automate every new dollar straight to principal. Progress feels slow during the first month, yet momentum compounds. Soon, minimum payments disappear, statements read Paid in Full, and the money you once fed to interest begins growing your net worth instead.

For more strategies to reduce your debt, see our guide, Debt-Free Living: 7 Proven Steps to Ditch Debt for Good.

Take Action Now: Block three hours this evening to set up your chosen gig, schedule your inaugural shift for Friday, and create an automatic transfer from your gig account to your smallest balance every Monday. By next July you could be debt-free—or at least thousands closer—because you turned weekends into wealth-building engines.