I. Introduction

Debt stress impacts not only finances but every aspect of life, making it hard to concentrate, work effectively, and maintain a sense of peace.

Debt-related stress is a growing issue worldwide. According to recent studies, over 70% of adults report feeling anxious about their finances, with debt being a primary cause.

The purpose of this article is to show you that there are effective ways to manage and reduce debt-related stress. It will offer straightforward, actionable strategies to help you take back control—both financially and emotionally. We’ll look into practical techniques for managing debt, stress reduction, and long-term habits that can lead to lasting relief.

II. Understanding Debt Stress

Financial obligations may burden individuals significantly, resulting in ongoing anxiety and worry about keeping up with monthly payments and managing debts. This debt stress often spills over into various parts of life, affecting mental health and overall well-being.

A. Common Causes of Debt Stress

Debt stress can stem from various financial obligations, each carrying its own pressures. Some of the most common causes include:

- Credit Card Debt:

High-interest credit card balances are a leading source of debt stress. The cycle of making minimum payments while interest accumulates can feel overwhelming, making it difficult to get ahead. For more details about credit cards, see our Understanding Credit Cards and Loans Ultimate Guide. - Student Loans:

Many individuals carry student loan debt well into adulthood. The pressure of large loan balances, stagnant wages, and job insecurity can lead to chronic stress. Learn more about such situations in our Mastering Student Loan Repayment Strategies guide. - Medical Bills:

Unexpected medical expenses can create financial hardship, even for those with insurance. The stress of dealing with mounting bills during health crises amplifies emotional strain. - Personal and Auto Loans:

Loans for cars, personal expenses, or home improvements can become burdensome if repayment terms aren’t manageable, especially after changes in income. Learn about Loan Calculator to control your car or personal loans. - Mortgage Debt:

Falling behind on mortgage payments risks foreclosure, causing extreme anxiety about losing one’s home—a fundamental security source. - Unexpected Financial Emergencies:

Job loss, economic downturns, or sudden large expenses can disrupt financial stability, triggering debt stress as people scramble to cover basic needs.

B. Emotional and Psychological Effects of Debt Stress

Debt isn’t just a number on a statement—it takes a toll on mental health. The emotional strain of debt can manifest in various ways:

- Anxiety:

Constant worry about bills, due dates, and financial obligations can lead to chronic anxiety. This may result in physical symptoms like rapid heart rate, shortness of breath, or restlessness. - Depression:

Prolonged debt stress can contribute to feelings of hopelessness, low self-esteem, and even depression. The sense of being “trapped” in debt can make it hard to stay motivated or optimistic about the future. - Sleep Issues:

Financial worries often lead to insomnia or poor sleep quality. Nighttime is when many people ruminate on their problems, which can disrupt sleep cycles and worsen stress. - Decision Fatigue:

The constant need to make financial decisions under pressure can exhaust mental resources, making it harder to think clearly and make sound choices. - Guilt and Shame:

Many individuals feel embarrassed about their debt, leading to isolation and reluctance to seek help. This emotional burden can intensify stress, making the problem feel even more overwhelming.

C. How Debt Stress Can Affect Relationships and Overall Quality of Life

Debt stress doesn’t exist in a vacuum—it often spills over into personal relationships and daily life. Here’s how:

- Strained Relationships:

Money issues are a common source of conflict among couples and families. Debt-related stress can lead to arguments, mistrust, and communication breakdowns, affecting emotional intimacy and stability. - Social Withdrawal:

People overwhelmed by debt may avoid social activities to cut costs or because they feel ashamed of their financial situation. This isolation can worsen feelings of loneliness and depression. - Impact on Work Performance:

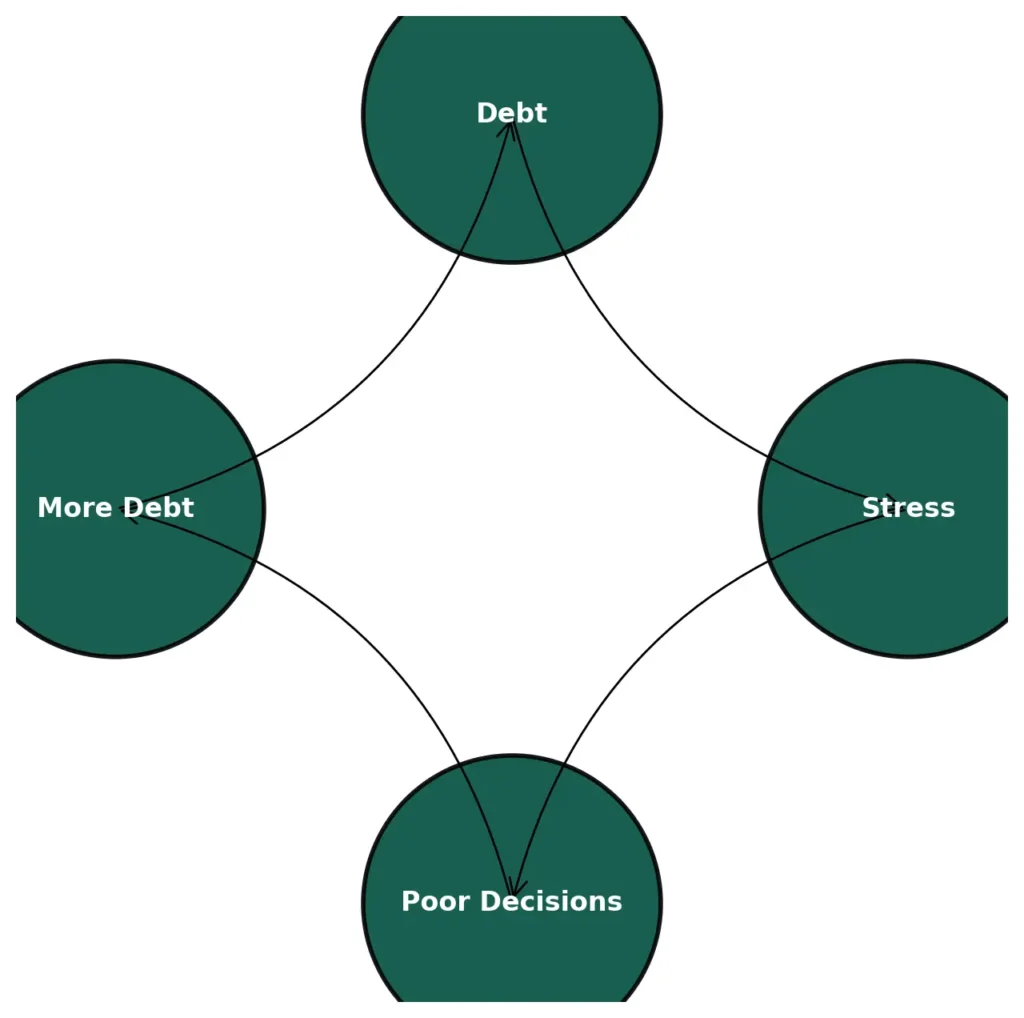

Debt stress can affect concentration, productivity, and decision-making at work. The distraction of financial worries may lead to decreased job performance or even job loss, creating a vicious cycle. - Reduced Quality of Life:

Constant financial anxiety can overshadow life’s joys. It can limit opportunities for travel, hobbies, or personal growth, leading to a sense of stagnation. - Health Issues:

Chronic stress is linked to physical health problems, including high blood pressure, weakened immune function, headaches, and gastrointestinal issues.

Key Takeaway:

Understanding the causes and effects of debt stress is the first step toward managing it. Recognizing how debt impacts your mental health and relationships can motivate you to seek solutions for your finances and overall well-being.

III. Signs and Symptoms of Debt Stress

Debt stress doesn’t just affect your bank account—it can have profound impacts on your body, mind, and behavior. Recognizing the signs early is crucial for managing both your financial situation and your overall well-being. These symptoms often manifest in three key areas: physical health, emotional stability, and behavioral patterns.

A. Physical Symptoms

Debt-related stress can trigger a range of physical symptoms due to the body’s response to chronic anxiety. When financial worries persist, stress hormones like cortisol remain elevated, affecting various bodily functions.

- Headaches and Migraines:

Tension headaches are common, often caused by prolonged stress, muscle tightness, and mental fatigue related to financial worries. - Fatigue:

Constant mental strain can drain your energy, leading to persistent tiredness even if you’re getting enough sleep. This exhaustion can make daily tasks feel overwhelming. - Digestive Issues:

Stress disrupts the digestive system, causing problems like stomach cramps, nausea, diarrhea, or constipation. Many people report gastrointestinal discomfort during periods of intense financial stress. - Sleep Disturbances:

Trouble falling asleep or staying asleep is a hallmark of debt stress. Racing thoughts about bills, debts, and financial obligations can lead to insomnia or restless sleep. - Increased Heart Rate and High Blood Pressure:

Chronic stress can elevate your heart rate and blood pressure, increasing the risk of cardiovascular problems over time. - Weakened Immune System:

Ongoing stress suppresses the immune system, making you more vulnerable to colds, infections, and other illnesses.

B. Emotional Symptoms

The emotional toll of debt stress can be just as debilitating as the financial burden itself. It affects your mood, mental health, and coping with everyday challenges.

- Constant Worry:

A pervasive sense of anxiety about your financial situation can dominate your thoughts. This worry may feel uncontrollable, even when you’re not actively dealing with financial matters. - Irritability and Frustration:

Financial stress can make you more prone to short tempers, mood swings, and frustration, especially in situations involving money decisions. - Hopelessness and Helplessness:

Feeling like you’re trapped in debt with no way out can lead to despair. Many people experience a sense of failure or inadequacy, believing they’ll never regain control over their finances. - Low Self-Esteem:

Debt can trigger feelings of shame or embarrassment, especially if you compare yourself to others who seem more financially stable. - Depression and Anxiety:

Prolonged financial stress can contribute to clinical depression or generalized anxiety disorder (GAD), requiring professional support. - Guilt:

Some individuals feel guilty about their spending habits, past financial decisions, or the impact of their debt on loved ones, further deepening emotional distress.

C. Behavioral Changes

Debt stress often leads to noticeable behavioral changes, some of which can worsen the financial situation if left unaddressed.

- Avoiding Bills and Financial Obligations:

Many people cope with debt stress by ignoring bills, avoiding phone calls from creditors, or refusing to check their bank accounts. This avoidance can lead to late fees, missed payments, and increased debt. - Overspending or Impulsive Purchases:

Ironically, stress can trigger emotional spending as a coping mechanism. Some individuals find temporary relief through shopping, even though it worsens their debt. - Social Withdrawal:

Financial struggles often cause people to withdraw from friends and family to avoid embarrassment or discussions about money. This isolation can intensify feelings of loneliness and depression. - Procrastination:

The overwhelming nature of debt can lead to procrastination, making it harder to address financial issues head-on. Delaying tasks like budgeting, bill payments, or debt management worsens the situation over time. - Neglecting Self-Care:

Stress can cause people to neglect basic self-care, such as skipping meals, avoiding exercise, or neglecting hygiene—all of which further impact mental and physical health. - Substance Abuse:

In extreme cases, individuals may turn to alcohol, drugs, or other unhealthy coping mechanisms to numb the emotional pain of debt stress.

Key Takeaway:

Recognizing these physical, emotional, and behavioral signs of debt stress is the first step toward regaining control. Ignoring the symptoms can lead to a financial and emotional downward spiral. The good news is that with the right strategies, support, and mindset, it’s possible to break free from this cycle.

IV. Strategies to Manage Debt Stress

Debt stress can feel overwhelming, but with the right strategies, you can regain control of your finances and reduce the emotional burden. Here’s a breakdown of actionable steps to manage debt stress effectively:

A. Financial Strategies

- Creating a Realistic Budget to Track Income and Expenses

- Start by listing all sources of income and monthly expenses.

- Use budgeting tools or apps to monitor spending and identify areas to cut back.

- Allocate a portion of your income specifically for debt repayment.

- Prioritizing Debts (e.g., Snowball or Avalanche Method)

- Snowball Method: First, focus on paying off the smallest debts to build momentum.

- Avalanche Method: Tackle high-interest debts first to save money on interest over time.

- Choose the method that aligns with your financial situation and motivates you.

- Negotiating with Creditors for Lower Interest Rates or Payment Plans

- Contact creditors to discuss options like reduced interest rates or extended payment terms.

- Many creditors are willing to work with you if you communicate proactively.

- Learn How to Negotiate a Debt Settlement with Creditors.

- Exploring Debt Consolidation or Refinancing Options

- Consolidate multiple debts into a single loan with a lower interest rate.

- Refinance high-interest loans (e.g., student loans or mortgages) to reduce monthly payments.

For more tips about financial solutions, see our Practical Budgeting Strategies: Tools, Tips, and Challenges guide.

B. Emotional and Mental Health Strategies

- Practicing Mindfulness and Stress-Reduction Techniques

- Engage in activities like meditation, deep breathing, or yoga to calm your mind.

- Set aside time daily to focus on relaxation and self-care.

- Seeking Support from Friends, Family, or Support Groups

- Share your concerns with trusted loved ones to alleviate the emotional burden.

- Join support groups or online communities for individuals facing similar challenges.

- Setting Small, Achievable Financial Goals to Regain Control

- Break down your debt repayment plan into smaller, manageable milestones.

- Celebrate each achievement to stay motivated and build confidence.

- Celebrating Progress to Stay Motivated

- Acknowledge every step forward, no matter how small.

- Reward yourself (without spending money) for sticking to your plan.

C. Lifestyle Changes

- Cutting Unnecessary Expenses to Free Up Funds for Debt Repayment

- Identify non-essential spending (e.g., subscriptions, dining out) and eliminate or reduce it.

- Redirect the saved money toward paying off debts.

- To develop your spending strategy, see our guide Smart Spending: Cutting Unnecessary Expenses.

- Building an Emergency Fund to Avoid Future Debt Stress

- Start small by setting aside a portion of your income for unexpected expenses.

- Aim to save 3-6 months’ worth of living expenses over time.

- Increasing Income Through Side Hustles or Part-Time Work

- Explore freelance work, gig economy jobs, or part-time opportunities.

- Use the extra income to accelerate debt repayment.

- Avoiding Additional Debt by Limiting Credit Card Use

- Switch to cash or debit cards to prevent overspending.

- If using credit cards, pay off the balance in full each month to avoid interest charges.

- Learn how to Escape the Debt Cycle.

By combining these financial, emotional, and lifestyle strategies, you can tackle debt stress head-on and work toward a more secure and peaceful financial future.

V. Seeking Professional Help

When debt stress overwhelms you, seeking professional help can provide clarity, guidance, and emotional support. Here are some options to consider:

A. Working with a Financial Advisor or Credit Counselor

- Financial Advisor

- A financial advisor can help you create a comprehensive plan to manage debt, budget effectively, and build long-term financial stability.

- They provide personalized advice based on your income, expenses, and financial goals.

- Learn how to choose the right financial advisor.

- Credit Counselor

- Nonprofit credit counseling agencies offer free or low-cost services to help you understand your debt and create a repayment plan.

- They can also negotiate with creditors on your behalf to lower interest rates or waive fees.

B. Exploring Debt Relief Programs or Bankruptcy as a Last Resort

- Debt Relief Programs

- Debt management plans (DMPs) consolidate your debts into a single monthly payment, often with reduced interest rates.

- Debt settlement programs negotiate with creditors to settle debts for less than the full amount owed, impacting your credit score.

- Bankruptcy

- Bankruptcy should only be considered a last resort when other options have been exhausted.

- Chapter 7 bankruptcy liquidates assets to pay off debts, while Chapter 13 allows you to reorganize and repay debts over time.

- Consult a bankruptcy attorney to understand the implications and process.

C. Consulting a Therapist or Counselor to Address Emotional Toll

- Therapy for Emotional Support

- Debt stress can take a significant toll on mental health, leading to anxiety, depression, or feelings of hopelessness.

- A licensed therapist or counselor can help you process these emotions and develop coping strategies.

- Support Groups

- Joining a support group for individuals dealing with financial stress can provide a sense of community and shared understanding.

- Many organizations offer free or low-cost group therapy sessions focused on financial stress.

- Holistic Approaches

- Some therapists specialize in financial therapy, which combines emotional support with practical financial guidance.

- Techniques like cognitive-behavioral therapy (CBT) can help reframe negative debt-related thought patterns.

Seeking professional help is a proactive step toward managing debt stress. Whether through financial guidance, debt relief programs, or emotional support, these resources can empower you to regain control and work toward a healthier financial future.

VI. Preventing Future Debt Stress

Once you’ve managed your current debt stress, the next step is to take proactive measures to avoid falling into the same situation again. You can build a stable and stress-free financial future by developing healthy financial habits, educating yourself, and creating a long-term plan.

A. Developing Healthy Financial Habits

- Saving Regularly

- Set up automatic transfers to a savings account to build an emergency fund.

- Aim to save at least 10-20% of your income, even if you start with small amounts.

- Budgeting Consistently

- Use budgeting tools or apps to track your income and expenses.

- Review your budget monthly to ensure you’re staying on track and adjust as needed.

- Investing Wisely

- Start investing early, even with small amounts, to grow your wealth over time.

- Consider low-risk options like index funds or retirement accounts (e.g., 401(k), IRA).

- Living Within Your Means

- Avoid lifestyle inflation by spending less than you earn.

- Prioritize needs over wants and make mindful spending decisions.

Learn about budgeting in our guide: Mastering the Basics of Budgeting.

B. Educating Yourself About Personal Finance and Debt Management

- Learning the Basics

- Read books, listen to podcasts, or take online courses on personal finance topics like budgeting, saving, and investing.

- Understand key concepts such as interest rates, credit scores, and debt-to-income ratios.

- Staying Informed

- Keep up with financial news and trends to make informed decisions.

- Follow reputable financial experts or organizations for advice and insights.

- Teaching Financial Literacy

- Share your knowledge with family members, especially younger generations, to help them avoid common financial pitfalls.

- Encourage open conversations about money to reduce stigma and promote healthy financial habits.

C. Building a Long-Term Financial Plan to Achieve Stability

- Setting Clear Financial Goals

- Define short-term, medium-term, and long-term goals (e.g., paying off debt, buying a home, retiring comfortably).

- Break down each goal into actionable steps with timelines.

- Creating a Financial Safety Net

- Build an emergency fund with 3-6 months’ worth of living expenses.

- Consider insurance policies (e.g., health, life, disability) to protect against unexpected events.

- Diversifying Income Streams

- Explore ways to generate additional income, such as side hustles, passive income investments, or freelance work.

- Diversifying your income can provide stability during economic downturns.

- Regularly Reviewing and Adjusting Your Plan

- Revisit your financial plan annually or after major life changes (e.g., marriage, job loss, having children).

- Make adjustments to stay aligned with your goals and current financial situation.

By focusing on these strategies, you can prevent future debt stress and create a solid foundation for financial stability. Healthy habits, ongoing education, and a well-thought-out plan will empower you to navigate life’s financial challenges confidently.

VII. Real-Life Stories of Overcoming Debt Stress

Hearing how others have successfully managed and overcome debt stress can be incredibly motivating. These real-life examples highlight the challenges people faced, the strategies they used, and the lessons they learned along the way.

A. Inspiring Examples of Individuals Who Managed and Overcame Debt Stress

- Sarah’s Journey from $50,000 in Debt to Financial Freedom

- Background: Sarah, a single mother of two, accumulated $50,000 in credit card debt after a job loss and medical emergencies.

- Strategy: She worked with a credit counselor to create a debt management plan, took on a part-time job, and cut unnecessary expenses like dining out and subscriptions.

- Outcome: Within five years, Sarah paid off her debt, built an emergency fund, and started investing in her children’s education fund.

- James and Maria’s Debt-Free Marriage

- Background: This couple entered marriage with $75,000 in combined student loans and credit card debt.

- Strategy: They used the debt snowball method, focusing on paying off smaller debts first while making minimum payments on larger ones. They also downsized their lifestyle, selling a second car and moving to a smaller apartment.

- Outcome: After three years, they became debt-free and saved enough for a down payment on their first home.

- David’s Turnaround After Bankruptcy

- Background: David, a small business owner, filed for Chapter 7 bankruptcy after his business failed, leaving him with $100,000 in debt.

- Strategy: He worked with a financial advisor to rebuild his credit, started a side hustle, and lived frugally to avoid new debt.

- Outcome: Within seven years, David rebuilt his credit score, started a new business, and now mentors others on financial recovery.

- Linda’s Story of Breaking the Paycheck-to-Paycheck Cycle

- Background: Linda struggled with $30,000 in credit card debt and lived paycheck to paycheck despite having a stable job.

- Strategy: She attended a financial literacy workshop, created a strict budget, and used the debt avalanche method to pay off high-interest debts first.

- Outcome: Linda paid off her debt in four years, started saving for retirement, and now teaches budgeting workshops in her community.

B. Key Takeaways and Lessons from Their Experiences

- Start Small and Stay Consistent

- Every journey begins with a single step. Even small changes, like cutting one expense or paying an extra $20 toward debt, can add up over time.

- Seek Help When Needed

- Whether it’s a credit counselor, financial advisor, or therapist, professional guidance can provide clarity and support.

- Prioritize and Strategize

- Using methods like the debt snowball or avalanche can help you stay focused and motivated.

- Lifestyle Changes Are Key

- Cutting unnecessary expenses, downsizing, or increasing income through side hustles can accelerate debt repayment.

- Celebrate Milestones

- Acknowledging progress, no matter how small, keeps you motivated and reinforces positive habits.

- Learn from Mistakes

- Many individuals emphasized the importance of understanding what led to their debt and making changes to avoid repeating those mistakes.

- Financial Education Is Empowering

- Gaining knowledge about personal finance and debt management helps you make informed decisions and build confidence.

- Resilience Pays Off

- Overcoming debt stress requires patience and perseverance, but the rewards—financial freedom and peace of mind—are worth it.

These real-life stories demonstrate that overcoming debt stress is possible with determination, the right strategies, and a willingness to seek help. By learning from their experiences, you can find inspiration and practical tips to tackle your own financial challenges.

VIII. Conclusion

Debt stress is more than just a financial burden—it can significantly affect your mental, emotional, and physical well-being. However, as we’ve explored in this article, it’s possible to overcome this challenge and regain control of your life.

A. Recap of the Importance of Addressing Debt Stress for Overall Well-Being

Debt stress doesn’t just affect your bank account; it impacts your relationships, health, and overall quality of life. By addressing the root causes of debt and implementing effective strategies, you can reduce stress, improve your mental health, and create a more stable financial future. Taking action is not just about numbers—it’s about reclaiming your peace of mind.

B. Encouragement to Take Proactive Steps Toward Financial and Emotional Relief

The journey to overcoming debt stress begins with small, intentional steps. Every effort counts whether it’s creating a budget, seeking professional help, or practicing mindfulness. Remember, you don’t have to face this alone—there are resources, tools, and support systems available to guide you. Take the first step today, no matter how small, and build momentum toward a brighter financial future.

C. Final Thoughts on Achieving a Debt-Free and Stress-Free Life

Achieving a debt-free life is not just about paying off what you owe; it’s about building a foundation for long-term financial stability and emotional well-being. By developing healthy financial habits, educating yourself, and creating a clear plan, you can break free from the cycle of debt stress and enjoy the freedom that comes with financial security.

Remember, progress takes time, and setbacks are a natural part of the journey. Stay patient, stay focused, and celebrate every victory along the way. A debt-free and stress-free life is within your reach—take the first step today and embrace the possibilities that lie ahead.

To learn about how to avoid debt, see our Debt-Free Living: Strategies and Mistakes to Avoid guide.

By addressing debt stress head-on and committing to positive change, you can transform your financial situation and create a life filled with peace, stability, and opportunity.