Understanding your credit score is crucial for anyone who wants to navigate the financial world effectively. A credit rating is basically a number that reflects how trustworthy you are when it comes to borrowing money based on your credit history and financial habits.

This score is key in deciding whether you qualify for loans, credit cards, or rental agreements. Lenders and financial institutions rely on credit scores to gauge the risk of lending money or extending credit to someone. Several factors come into play when calculating this score, including your payment history, how much credit you’re using, the length of your credit history, the types of credit accounts you have, and any recent inquiries.

By understanding the importance of credit scores and their determination, you can take proactive steps to boost your financial health and make smarter choices about your credit.

In this guide, we develop the following points:

What Is a Credit Score?

A credit score is a three-digit number that represents your financial reliability. Lenders, landlords, and even employers use it to assess your creditworthiness. A high score can lead to lower interest rates and better financial options, while a low score can limit borrowing opportunities and increase costs.

How the Credit Score is Calculated

Credit scores are determined using multiple factors, each weighted differently:

- Payment History (35%) – Timely bill payments boost your score, while late payments, defaults, and bankruptcies lower it.

- Credit Utilization (30%)— Using less than 30% of your available credit is ideal. High utilization can negatively impact your score.

- Credit History Length (15%) – The longer your credit accounts have been open, the better it is for your score.

- Credit Mix (10%) – Managing different types of credit, such as credit cards, mortgages, and auto loans, can improve your score.

- Credit Inquiries (10%) – Hard inquiries from applying for new credit can slightly reduce your score. Multiple inquiries in a short period may indicate financial distress.

Types of Credit Scores

There are two main credit scoring models:

FICO Score

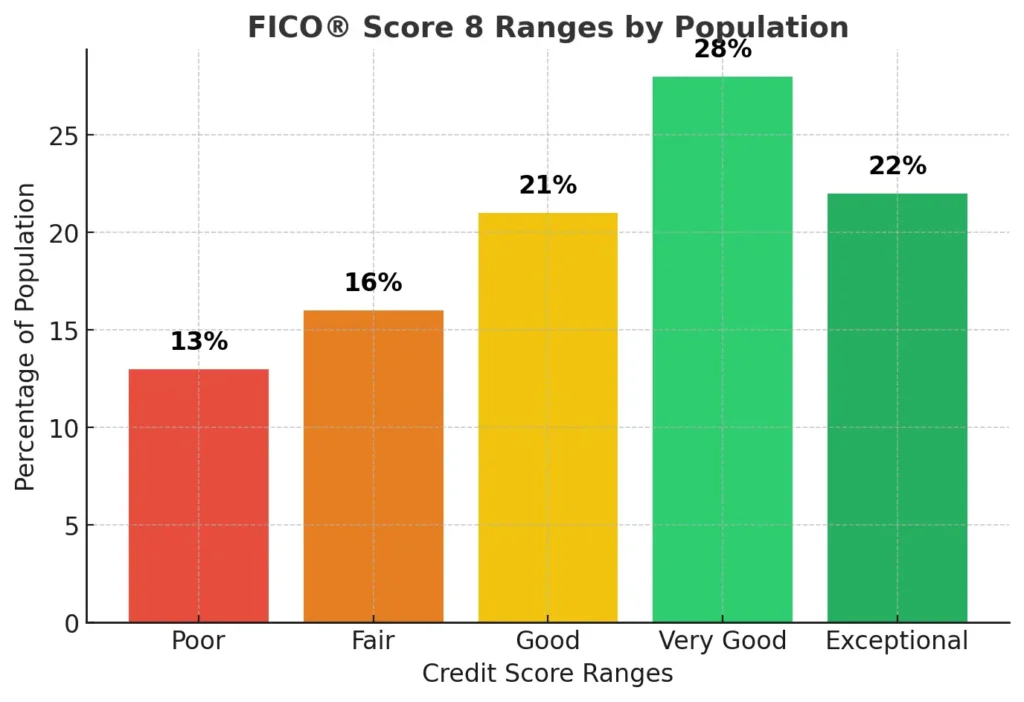

The FICO Score is a well-known credit scoring system that lenders rely on to evaluate how trustworthy someone is when it comes to borrowing money. Created by the Fair Isaac Corporation, this score falls between 300 and 850, with higher numbers showing a lower risk for lenders. It considers several factors, such as your payment history, how much you owe, the length of your credit history, the types of credit you have, and any recent credit inquiries. Having a solid FICO Score can greatly boost your chances of getting loans or securing better interest rates, making it a vital part of managing your personal finances. By understanding and keeping an eye on your FICO Score, you can take charge of your financial choices and work towards improving your overall credit health.

VantageScore

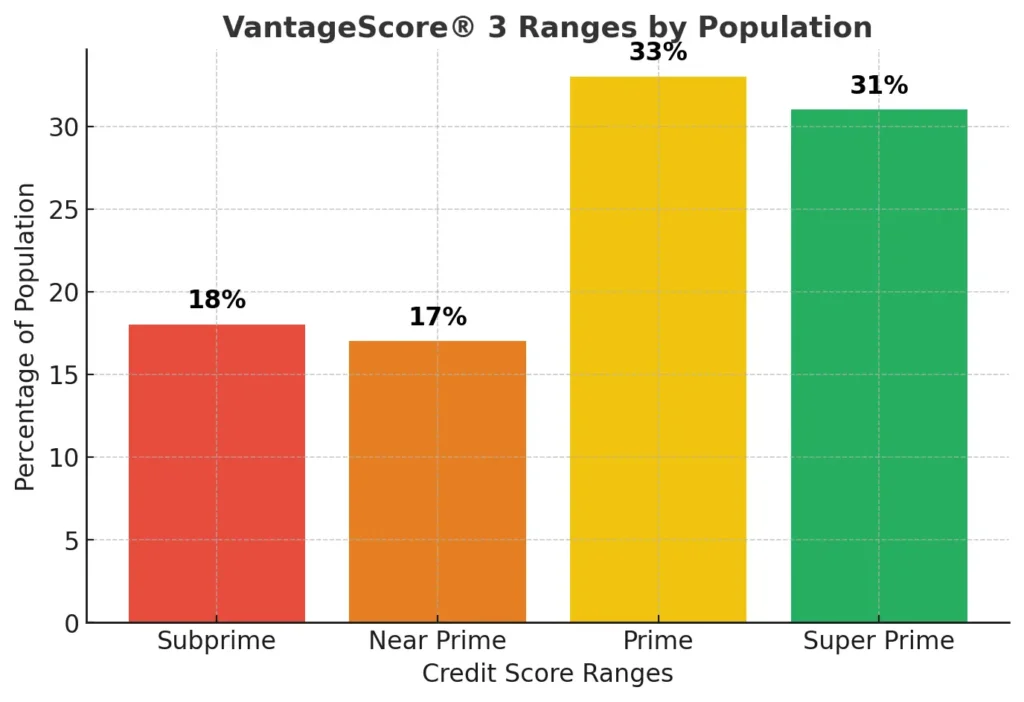

VantageScore is a credit scoring model that was created through a collaboration of the three major credit bureaus: Experian, TransUnion, and Equifax. The goal of this scoring system is to give lenders a trustworthy way to assess a consumer’s creditworthiness, which helps them make better decisions about loans and credit applications. What sets VantageScore apart from traditional scoring models is its use of a wider variety of data. It takes into account factors like payment history, credit utilization, and the types of credit accounts a person has, resulting in a score that more accurately reflects their financial behavior. This fresh approach not only boosts the predictive accuracy of credit scores but also enables a more inclusive assessment of potential borrowers, especially those who may have limited credit histories.

Lenders may use either model, so monitoring both is recommended.

Why Your Credit Score Matters

Your credit score significantly influences your financial life. Here are the primary ways it affects you:

- Loan Approvals – A higher credit rating increases your chances of getting approved for a loan with better terms.

- Interest Rates – Lower scores result in higher interest rates, making borrowing more expensive.

- Renting an Apartment – Landlords check credit scores to assess rental applicants.

- Insurance Premiums – Some insurers use credit scores to determine policy costs.

- Employment Opportunities – Certain employers review credit reports for financial-related roles.

What Is a Good Credit Score?

Credit scores are classified into different ranges:

- Excellent (800 and above) – Offers the best loan terms and lowest interest rates.

- Good (740-799) – Grants access to competitive loan options.

- Fair (670-739) – Considered average, but some restrictions may apply.

- Poor (580-669) – Limited borrowing options with higher interest rates.

- Bad (Below 580) – High risk for lenders, often requiring collateral or a co-signer.

Different industries set varying thresholds for credit scores. For example:

- Mortgage lenders prefer scores above 620 for conventional loans.

- Auto lenders offer better rates for scores above 660.

- Credit card issuers typically require a 700+ score for premium cards.

How to Improve Your Credit Score

Improving your credit rating takes time and disciplined financial habits. Here are proven steps to boost your score:

1. Pay Bills on Time

- Payment history is the most significant factor in credit scoring.

- Set up automatic payments or reminders to avoid missing due dates.

- Even a single late payment can lower your score for years.

2. Reduce Credit Card Balances

- Keep your credit utilization below 30% and ideally under 10%.

- Pay balances in full each month to avoid interest charges.

- Consider making multiple payments throughout the billing cycle.

3. Limit New Credit Applications

- Hard inquiries stay on your report for up to two years.

- Apply for new credit only when necessary.

- If shopping for a loan, submit applications quickly to minimize impact.

4. Keep Old Accounts Open

- The length of your credit history contributes to 15% of your score.

- Closing old accounts can shorten your credit history and increase utilization.

- Keep older accounts active with occasional small purchases.

5. Dispute Credit Report Errors

- Regularly check your credit report for inaccuracies.

- Dispute incorrect payment histories or unauthorized accounts with credit bureaus.

- Use AnnualCreditReport.com to access free reports from Experian, Equifax, and TransUnion.

Common Myths About Credit Scores

1. Checking Your Credit Score Lowers It

- Truth: Soft inquiries (self-checks) do not affect your score. Only hard inquiries (from lenders) have a temporary impact.

2. Closing Credit Cards Improves Your Score

- Truth: Closing accounts can hurt your score by reducing your available credit and shortening your credit history.

3. You Only Need a Good Score for Loans

- Truth: Your credit rating affects renting, insurance rates, and even job applications in financial sectors.

How to Monitor Your Credit Score

Regular monitoring helps identify issues before they affect your score.

Free and Paid Credit Monitoring Tools

- Free Tools: Credit Karma, Credit Sesame, and bank-provided services.

- Paid Services: MyFICO, Experian CreditWorks, and identity theft protection services.

How Often to Check Your Score

- Monthly: Use free credit monitoring tools.

- Before Major Purchases: Check before applying for a mortgage or auto loan.

- Annually: Review full credit reports for accuracy.

Red Flags to Watch For

- Unauthorized accounts or inquiries.

- Sudden drops in your score.

- Incorrect account balances or payment records.

Long-Term Strategies for Credit Health

Maintaining a strong credit score requires consistent effort:

1. Build a Strong Credit History

- Start early with responsible credit use.

- Maintain long-term credit relationships.

- Avoid missing payments at all costs.

2. Diversify Credit Types

- Use a mix of revolving (credit cards) and installment (loans) credit. For actionable methods, see our guide, Understanding Credit Cards and Loans.

- Avoid unnecessary new debt but diversify when beneficial. For that purpose, see our guide, How to Escape the Debt Cycle.

3. Stay Disciplined with Spending

- Follow a budget to prevent overspending. See our guide to master the basics of budgeting.

- Keep credit utilization low.

- Build an emergency fund to avoid reliance on credit.

FAQs

What is the fastest way to improve a credit score?

Paying off debts, reducing credit utilization, and correcting credit report errors can provide quick improvements. For more details, see our guide Debt Consolidation Simplified: Easy Strategies to Save.

How long does it take to repair a bad credit score?

It depends on the severity of past issues. Minor improvements may show within months, while major repairs can take years.

Does paying off a loan improve my score immediately?

It can, but the impact depends on other credit factors. Keeping older accounts open is beneficial.

What happens if I don’t use my credit card at all?

Inactivity may lead to account closure, shortening your credit history and potentially lowering your score.

What to Do if You Don’t Have a Credit Score?

If you have no credit history, start by applying for a secured credit card or becoming an authorized user on a family member’s account. Paying bills on time and using credit responsibly will help establish your credit rating.

Why Are There Different Credit Scores?

Different credit scores exist because various scoring models, such as FICO and VantageScore, use unique algorithms to evaluate credit history. Lenders may use different models based on their specific criteria, leading to score variations.

Conclusion

Your credit score is a crucial financial tool influencing borrowing, renting, and employment opportunities. You can maintain a strong financial standing by consistently paying bills on time, keeping credit utilization low, avoiding unnecessary inquiries, and monitoring your credit report. Take action today to improve your credit health and secure a brighter financial future.

Consider consulting the Consumer Financial Protection Bureau’s guide on credit scores for comprehensive information on maintaining and improving your credit rating.